Sunny Loans has gone into Administration!

Elevate Credit International (ECIL), which is Sunny loans parent company is now under the administration of KPMG. Effectively, leaving 50,000 customers that need soft loans in jeopardy. This move comes in the wake of a nation-wide government clampdown on quick loans UK providers.

The coronavirus pandemic has also exacerbated the situation. Many customers have found it hard to pay their outstanding loans on time due to reduced incomes.

Sunny Loans, isn’t the first loan site to go into administration, Quickquid and 247 Moneybox also went under in the past two years.

What does this mean for sunny loan customers?

Many sunny loans customers felt burdened by the costs of doing business with Sunny loans and other payday firms. However, it’s best to focus on making the future less stressful.

First, you need to keep following the proceedings as the KPMG sorts out the books at Sunny Loans. The advice given here is based on what happened in other quick loan firms. We promise to keep you updated.

Customers should look out for emails from the administrators during this period. It wise for you to also check your spam folder in case any of these emails end up there. You’ll also need to file a claim form as soon as possible to be entitled to a refund.

What should you do if you have an outstanding Sunny loan?

We’ll it means that you can’t get a new loan from the firm. The good news is you still have access to your account on the website even during the administration period. You’ll, however, need to continue making regular loan repayments since you’ll accrue more interest on outstanding balances.

Many customers fee tempted to stop making repayment at such uncertain times. But, this move is inadvisable as you’ll be subject to additional charges. Your credit score may also take a hit, which would make getting loans from other lending firms more challenging in the future.

What to do if you can’t repay your Sunny loan?

Certain cases merit some exemption or flexibility from sunny loans. In such a case, you can lodge a complaint or seek personalised advice from Sunny’s customer care service. You can reach out to them by calling 0800 7315 444 or via Email.

Other measures you can take include;

- Settle on a flexible loan repayment plan

Banking laws can compel loan firms to pause all repayments for a reasonable time. This can give you some time to speak to a debt adviser that will make it easier for you to meet your loan obligations. The law also requires loaning firms to freeze further charges and interest until the end of the intervening period.

- Declining loan rollovers

The representative from sunny loans may advise you to roll over all payments into the next month. This may seem like an excellent idea, but it’s not always the best option.

It only increases the amount you owe in interest and other standing charges. So, settling on a flexible repayment option would be your best bet in such a situation.

- Cancelling recurring payments

Consider taking this step only after consulting a representative from sunny loans. This is a risky move as it may damage your credit score. However, sometimes you need every penny for food, rent, and other utility bills.

This is especially true during this challenging coronavirus pandemic. So, take some time while carefully looking at other options before settling on such a move. You can also speak to your accountant or seek some free debt advice.

- Seeking affordable or fee debt advice.

Dealing with payday lenders can prove challenging. Most people don’t even know how to approach them to discuss such matters. You can speak to your accountant or a qualified loan adviser to find a way out of your current situation.

Charitable organisations such as Advice NI and StepChange Debt Charity can help you out of such a situation. Please reach out to them for some free debt advice.

Still looking for a Sunny payday loan?

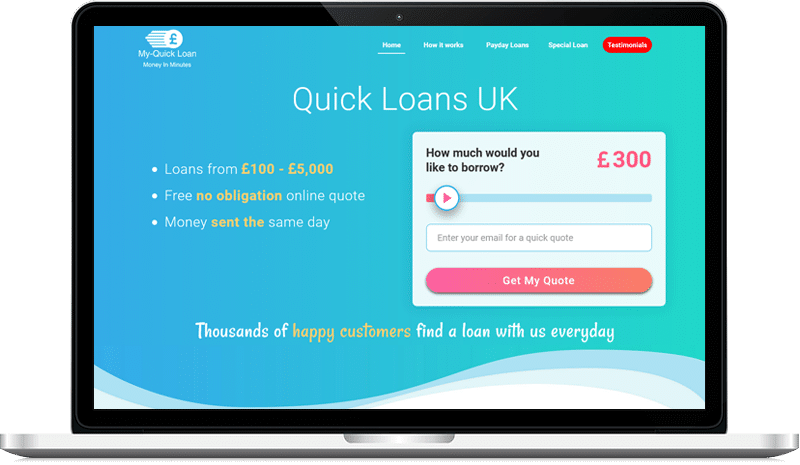

If you are still looking for an instant payday loan My Quick Loan could help, we work a large panel of lenders who could help you get a loan. We can help with loans from £100 – £5,000 which are usually paid out the same day.

Get your free loan quote today

Access from £100 to £5,000